FAQ

What is an appraisal?

A home purchase is the largest single investment most people will ever make. Whether it's a primary residence, a second vacation home or an investment, the purchase of real estate is a complex financial transaction that requires multiple parties to pull it all off.

The sale is usually handled by the Realtor. Financial capital to fund the transaction is provided by the bank, credit union or Mortgage Company. The title company ensures that all aspects of the transaction are completed and that a clear title passes from the seller to the buyer.

But who ensures that the value of the property is in line with the asking price or selling price?

This is where the appraisal comes in. An appraisal is an objective estimate of what a buyer might expect to pay – or a seller receive – for a parcel of real estate, where both buyer and seller are informed parties. A licensed or certified appraiser will provide the most accurate estimate of the true value of their property, thus ensuring both buyer and seller are making an informed decision.

Why do I need an appraisal?

1) Selling – If you're selling your home, you want to get a fair price for the property, and you also want the house to sell as quickly as possible. If your asking price is too low, you lose equity in the sale. If your asking price is too high, your listing may sit for months or years with no interest. So how does a homeowner know what price to ask? An appraisal of the property is the best and most objective and accurate estimate of value and it provides the information a seller needs to effectively list and sell a home. Why not ask a Realtor? – Appraisers, unlike realtors do not have a vested interest in the selling price of the home. Also, an appraiser has specific training that a realtor does not that allows an appraiser to methodically determine an objective value.

2) Buying – As a buyer, you wish to get the most value for the money you'll spend on your home purchase. Sellers sometimes overestimate the value of a home due to emotional attachment. The appraisal will determine the most objective assessment of value of a property and thus give a buyer the information necessary to make a sound purchase.

3) Divorce

– A divorce can be a particularly traumatic experience for both parties and is often further complicated by trying to determine the division of property regarding the house. Whether the court decides to award the property to one party or orders the sale of the property and division of the proceeds, the best way to ensure that both parties are fully aware of the true market value is to order an appraisal. If the parties want to sell the home, they'll have a better idea of what price to set or if a buy out is the chosen option, both parties will feel like they've gotten a fair assessment.

4) Estate – The loss of a loved one is a difficult time in life and settling an estate from a death or probate often requires an appraisal to establish Fair Market Value for the residential property involved. In most cases, a home or other real property makes up a disproportionate share of the total estate value and an appraiser can help determine the true value, allowing equitable arrangements to be determined by disputing parties. Everyone walks away knowing they've received a fair deal.

4) Estate – The loss of a loved one is a difficult time in life and settling an estate from a death or probate often requires an appraisal to establish Fair Market Value for the residential property involved. In most cases, a home or other real property makes up a disproportionate share of the total estate value and an appraiser can help determine the true value, allowing equitable arrangements to be determined by disputing parties. Everyone walks away knowing they've received a fair deal.

5) Refinance – If you want to tap into the equity of your home or negotiate a better interest rate, you'll need a new loan. This often requires a new appraisal on the property

6) Property Taxes – If you feel that your property taxes are too high because your home is overvalued, an appraisal may help you dispute your assessment and lower your taxes.

How do I prepare for an appraisal?

The first thing to happen is the inspection. An appraiser must inspect the property to ascertain its true status. The appraiser must visually verify the features, such as the number of bedrooms, bathrooms, etc to ensure they exist and are in the condition a reasonable buyer would expect. Usually an inspection will include a sketch of the property to determine the layout and square footage. Most importantly, the appraiser will look for any obvious defects or other conditions that might affect the value of the property.Once the site has been inspected, the appraiser will use two or three different methodologies to determine the value of real property. These approaches will be included in the appraisal report. Preparing for the inspection is easy. Just make sure the appraiser has unobstructed access to all areas of the property, including crawl spaces and attics. Pets should be kenneled or removed if they are not friendly and/or you are not home.

What does an appraisal report contain?

The appraisal report will contain photos of your property as well as a sketch showing the dwelling dimensions, room locations and auxiliary structures. At least three recent sold properties similar to yours and perhaps current listings will be compared to your property on a grid to produce an estimated market value of your property as of the date it was inspected. The appraiser may also develop the Cost Approach if your home is newer or the Income Approach if it is rented.

The report should contain sufficient information to allow you to understand how the appraiser arrived at the value. However, if you have any questions, we are always happy to answer them.

What can I do to improve my home value?

Before you decide to sell your home, there are several decisions to be made. First and foremost: “How much should it sell for?” But don't forget there may be other equally important questions to ask yourself such as:

“Would it be better to paint the entire house before we sell it?”

“Should I put in that third bathroom?”

“Should I complete my kitchen remodel?”

Your appraiser can help you decide what projects might add the most value to your home.

What is PMI and how can I have it removed?

Private Mortgage Insurance or PMI is the supplemental insurance that many lenders ask home buyers to purchase when the amount being loaned is more than 80% of the value of the home. Very often, this additional payment is folded into the monthly mortgage payment. Many homeowners are unaware or forget about the PMI payments and don't realize that federal law requires that lenders, upon request, must remove PMI once the remaining balance of the loan- whether through market appreciation or principal down payment- falls below the 80% mark and the loan-to-value ration conditions have been met. Appraisers can offer a specific service to help homeowners determine if PMI can be removed.

Browse our website

Contact Information

Rock Valley Appraisal Service

Phone:

608-755-1228

E-mail:

office@rockvalleyappraisal.com

Fax: 608-755-1229

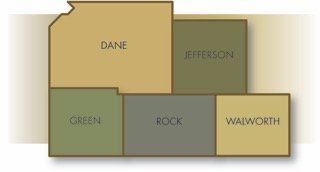

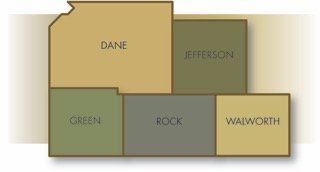

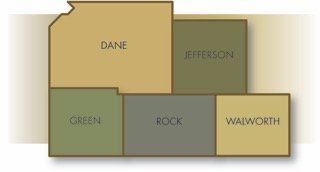

Madison & Janesville, Wisconsin

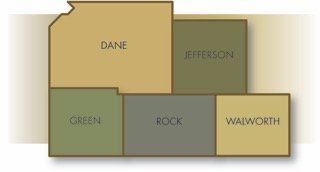

Service Area

Browse our website

Contact Information

Rock Valley Appraisal Service

Phone:

608-755-1228

E-mail:

office@rockvalleyappraisal.com

Fax: 608-755-1229

Madison & Janesville, Wisconsin

Service Area

Browse our website

Visit Us

Contact Information

Rock Valley Appraisal Service

Phone:

608-755-1228

E-mail:

office@rockvalleyappraisal.com

Fax: 608-755-1229

Madison & Janesville, Wisconsin

Service Area

Content, including images, displayed on this website is protected by copyright laws. Downloading, republication, retransmission or reproduction of content on this website is strictly prohibited. Terms of Use

| Privacy Policy